Insightful Bytes

Exploring the world one byte at a time.

Whole Life Insurance: A Safety Net or a Money Pit?

Is whole life insurance your safety net or just a costly mistake? Discover the truth and make informed choices today!

Is Whole Life Insurance Worth the Investment? Exploring the Pros and Cons

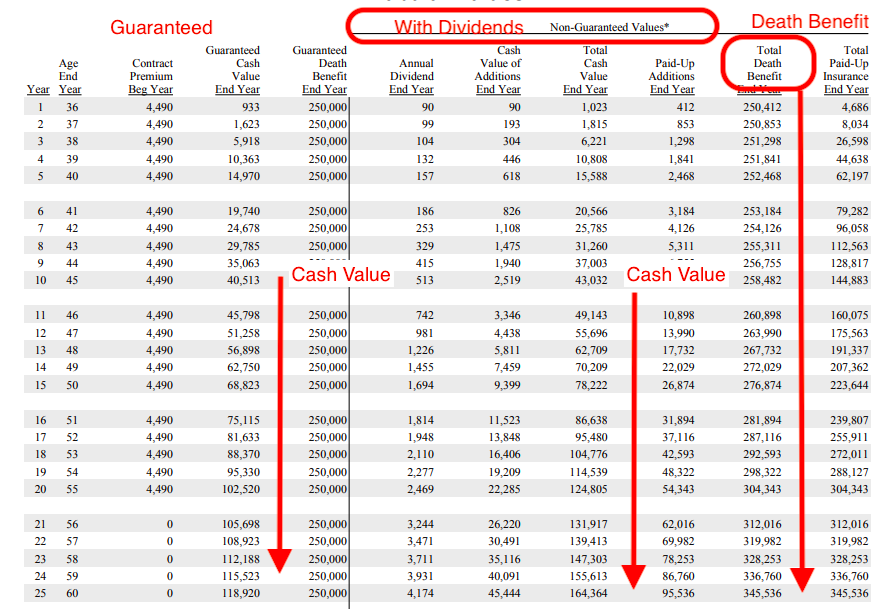

Whole life insurance is often seen as a long-term investment strategy that offers not only a death benefit for your beneficiaries but also a cash value component that grows over time. One of the main advantages of this type of insurance is the guaranteed death benefit, which provides peace of mind to policyholders and their families. Additionally, the cash value accumulates on a tax-deferred basis, allowing you to take loans against it or cash it out if needed. However, it’s essential to consider the pros and cons of whole life insurance to determine if it aligns with your financial goals.

On the downside, the premium costs for whole life insurance are significantly higher than those for term life insurance, which can make it a more expensive choice for many individuals. Furthermore, the cash value growth is generally slower compared to other investment options, such as mutual funds or stocks. Critics argue that this makes whole life insurance less flexible and less worthwhile compared to traditional investment vehicles. Ultimately, deciding if whole life insurance is worth the investment requires careful consideration of your financial situation and long-term goals.

Whole Life Insurance: How It Can Provide Financial Security for Your Family

Whole life insurance is a financial tool that offers long-term security for your family by providing a death benefit and accumulating cash value over time. Unlike term life insurance, which only lasts for a specific period, whole life insurance remains in effect for the policyholder's entire life, as long as premiums are paid. This not only ensures that your loved ones are financially protected in the event of your passing but also serves as a savings component, allowing you to access cash value during your lifetime. Many families opt for this type of insurance as a means of securing their financial future and alleviating worries about unforeseen circumstances.

Additionally, whole life insurance can enhance your family's financial security by acting as a reliable asset that can be borrowed against or cashed out if needed. This can be particularly advantageous during emergencies or when unexpected expenses arise. The guaranteed death benefit and cash value growth provide a sense of stability, making it a prudent choice for those looking to safeguard their family's financial well-being. By investing in whole life insurance, you are not just purchasing a policy; you are creating a legacy of protection and peace of mind for your loved ones.

Common Myths About Whole Life Insurance: What You Need to Know

Whole life insurance is often surrounded by a cloud of misconceptions that can lead to poor financial decisions. One of the most prevalent myths is that whole life insurance is too expensive compared to term life insurance. While it is true that the premiums for whole life policies are generally higher, they also provide lifelong coverage and a cash value component that grows over time. This cash value can be borrowed against or withdrawn, making whole life insurance not just a safety net for beneficiaries, but also a potential asset for the policyholder.

Another common myth is that whole life insurance offers no real benefits unless the insured passes away. In reality, whole life insurance can be a valuable financial tool while the policyholder is alive. With its guaranteed death benefit, predictable premium payments, and cash value growth, it serves as both protection and a way to supplement retirement income or fund major life expenses. Understanding these aspects can help individuals make informed decisions about their insurance coverage and financial planning.