Insightful Bytes

Exploring the world one byte at a time.

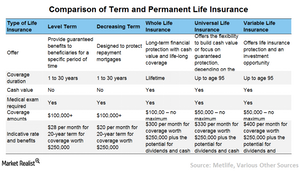

Insurance Showdown: Finding Your Policy Match

Uncover the secrets to your perfect insurance policy match in our ultimate showdown! Discover tips, tricks, and expert insights today!

Top 5 Insurance Policies You Didn't Know You Needed

When it comes to securing your financial future, many individuals overlook essential insurance policies that can offer invaluable protection. Here are the Top 5 Insurance Policies You Didn't Know You Needed, which might just save you from unforeseen financial burden in the long run:

- Umbrella Insurance: This policy provides extra liability coverage beyond the limits of your existing home, auto, or boat insurance. If an accident occurs, it can help cover legal fees and damages that might exceed your primary policy's limits. For more on umbrella insurance, check out this Investopedia article.

- Identity Theft Insurance: With the rise of digital transactions, protecting your identity has never been more critical. This insurance can cover the costs associated with restoring your identity after theft. Learn more about it from this Consumer Reports guide.

Is Your Current Insurance Policy Still the Right Fit?

When assessing whether your current insurance policy is still the right fit, it's essential to consider significant life changes that may affect your coverage needs. Events such as a new job, marriage, or the birth of a child can all necessitate a reevaluation of your policy. Additionally, as you acquire new assets, like a home or a vehicle, you may require additional coverage to protect your investments. For guidance on assessing your insurance needs, check out this helpful resource on understanding insurance needs.

Furthermore, regularly reviewing your insurance policy ensures you're not overpaying for coverage you no longer need. For instance, if you’ve paid off a loan, you might not need the same level of coverage on your life insurance policy. It's also wise to compare your current premiums with quotes from other providers. Websites like Policygenius can help you find better deals. By conducting an annual review of your insurance coverage, you can ensure your policy continues to serve your best interests and provides financial security.

How to Compare Insurance Policies: A Step-by-Step Guide

Comparing insurance policies can seem overwhelming, but approaching the task methodically can simplify the process. Begin by identifying your needs—what type of insurance are you looking for? Whether it's car, home, or health insurance, understanding your specific requirements is crucial. Next, gather quotes from multiple insurers. You can visit websites like NerdWallet to compare rates easily. Once you've collected quotes, you can start comparing the coverage options available to you.

In the next steps, examine the policy details. Pay close attention to the limits of coverage, deductibles, and any exclusions that might apply. It's also essential to look at customer reviews and ratings to see how insurers handle claims. Websites like J.D. Power provide valuable consumer insights. Finally, don't hesitate to reach out to agents for personalized advice. After gathering all this information, you can make an informed decision that best suits your needs.