Insightful Bytes

Exploring the world one byte at a time.

Uncovering Hidden Treasures: Auto Insurance Discounts You Never Knew Existed

Discover hidden auto insurance discounts that could save you money—unveil the secrets and boost your savings today!

Maximizing Your Savings: Little-Known Auto Insurance Discounts to Explore

When it comes to maximizing your savings on auto insurance, many drivers overlook valuable discounts that can significantly reduce their premiums. For instance, did you know that safe driving records can qualify you for a discount? Insurance companies often reward drivers who maintain a clean driving history by offering discounts. Additionally, bundling your auto insurance with other policies, such as home or renters insurance, can lead to substantial savings. To give you an idea of how much you could save, consider the following list of common auto insurance discounts:

- Multi-Policy Discount

- Good Student Discount

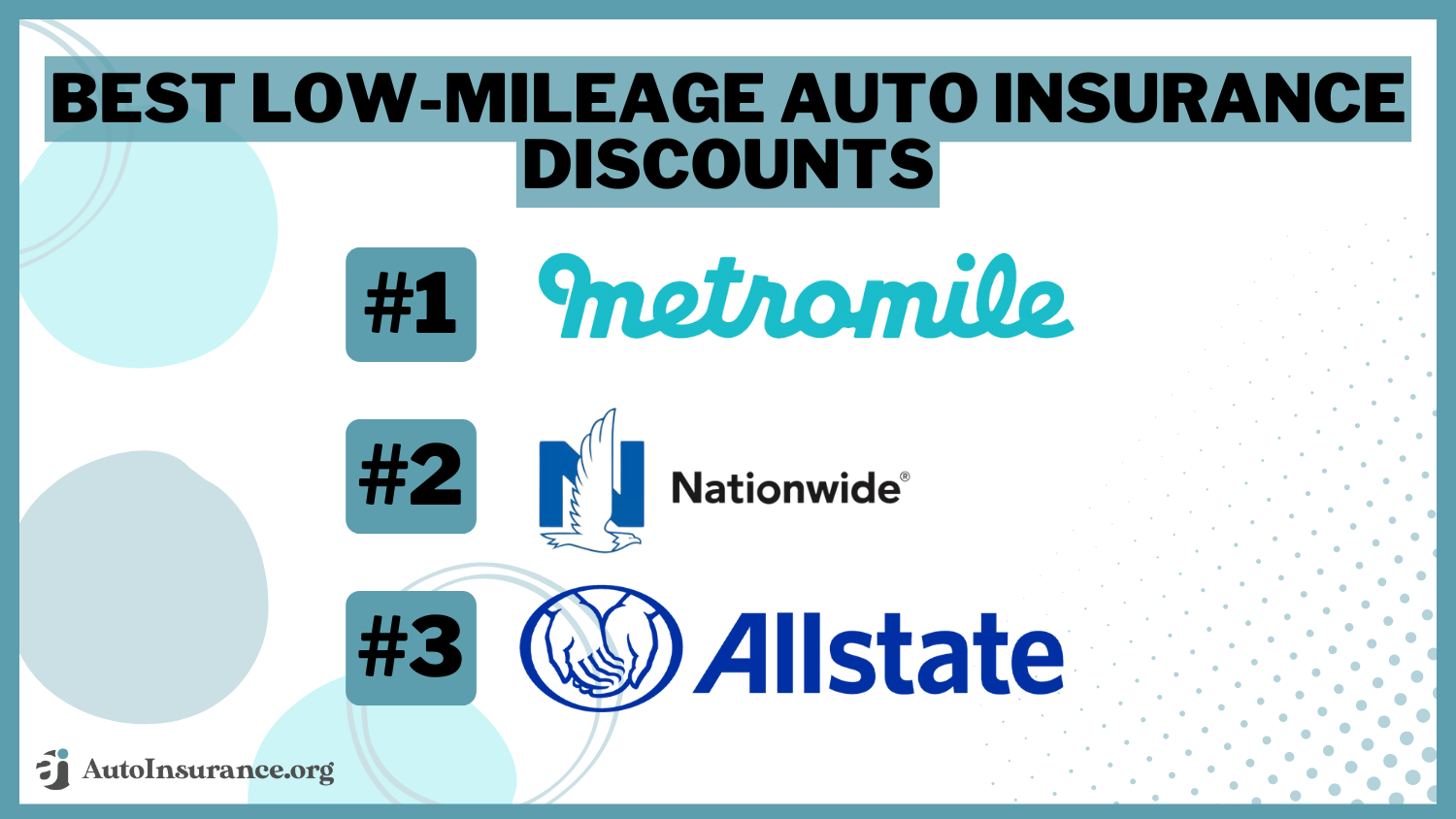

- Low Mileage Discount

- Military Discount

Another little-known way to maximize your savings is by auditing your coverage regularly. Many drivers may not realize that certain features or coverages may no longer be necessary. For instance, if your vehicle has significantly decreased in value, reconsidering comprehensive and collision coverage might benefit you financially. Moreover, consider asking your provider about lesser-known discounts, like those for electric or hybrid vehicle owners. For more insights, check out this helpful article on NerdWallet that outlines additional discounts you might qualify for. By exploring these options, you can ensure that you’re not paying more than necessary for your auto insurance.

Are You Missing Out? Hidden Auto Insurance Discounts You Should Know About

Many drivers are unaware that they could be saving money on their auto insurance premiums through various hidden discounts. For instance, did you know that bundling your auto insurance with other policies, like homeowners or renters insurance, can lead to significant savings? This is commonly known as a bundling discount. Additionally, certain insurers offer discounts for maintaining a good driving record or completing a defensive driving course. Exploring these options can help you cut down on costs dramatically while maintaining the coverage you need.

Another lesser-known approach to finding hidden auto insurance discounts is taking advantage of your affiliations. Many organizations, from alumni associations to professional groups, have established partnerships with insurance providers, which can result in exclusive discounts for members. Furthermore, some insurers also reward loyalty with marked-down rates for long-term customers. Be sure to check with your insurer to learn about any available discounts that you may qualify for. You might be surprised at how much you can save just by asking! For more detailed insight into auto insurance savings, visit Insurance.com.

Unlocking Discounts: A Comprehensive Guide to Auto Insurance Savings

Saving money on auto insurance doesn’t have to be a daunting task. By understanding the various discounts offered by insurance providers, policyholders can unlock significant savings on their premiums. First and foremost, it’s essential to shop around and compare quotes from different companies. According to the NerdWallet, comparing at least three quotes can help you find the best deal tailored to your needs. Moreover, many insurers provide discounts for bundling policies, maintaining a good driving record, or even for being a member of certain organizations.

Another valuable strategy for unlocking auto insurance savings is to take advantage of available programs and incentives. For instance, many insurance companies offer safe driving discounts, which reward drivers with lower rates for maintaining a clean driving history. Additionally, enrolling in a defensive driving course can often lead to further reductions in premiums. Other factors that could yield discounts include your vehicle's safety features and your annual mileage. To discover more tips for maximizing your auto insurance savings, visit the Bankrate.